Account-based pensions are the most popular type of retirement income stream for retirees. They offer both flexibility and ease of understanding and can be purchased from a professional fund manager or run within a self-managed superannuation fund.

What are account-based pensions?

An account-based pension is basically an income stream that is payable from a superannuation fund.

Anyone with accessible superannuation money – that is, “unrestricted non-preserved” superannuation money – can either rollover to, or directly purchase, an account-based pension. You don’t necessarily need to be retired to start the pension, but you do need to have met a condition of release so that your money becomes accessible. In some cases, you can open an account-based pension even before your superannuation money becomes unrestricted non-preserved but you should seek help from a financial planner to determine if this is appropriate for you.

You can purchase an “off the shelf” account-based pension from a fund manager, or alternatively, you can commence one within your own self managed superannuation fund.

How do account-based pensions work?

Account-based pensions operate quite similarly to a regular bank account. Investment earnings top up the account balance, while it is reduced by withdrawals in the form of regular pension payments.

Pension payments within a financial year must be at least equal to the legislated minimum amount but note there is no maximum so you can choose how much you want to receive. A maximum payment applies to account-based pensions commenced using the transition to retirement rules. You can elect to receive payments at regular intervals, for example, monthly, quarterly, half-yearly or annually.

In addition to regular pension payments, lump sum withdrawals – known as ‘commutations’ – may be made from account-based pensions.

Account-based pensions can be invested in a broad range of investment options that can be selected to suit your needs. They allow investment in the major assets classes such as cash, bonds, shares and property in addition to alternative assets classes if desired and depending on the offer by your selected provider.

Why are account-based pensions so popular?

The popularity of account-based pensions is due to tax concessions but also due to their flexibility and versatility. Account-based pensions allow flexibility in relation to income, access to capital, investment options and payment possibilities in the event of your death.

Each year you need to take a minimum pension payment from your pension but you have a great deal of flexibility to increase the pension payment anywhere up to 100% of the account balance (unless commenced under the transition to retirement rules). How much you take will impact how long your pension lasts. If you need additional money in a particular year you can take out extra by increasing income or taking a lump sum commutation.

If you are age 60 or over and the pension is paid from a ‘taxed’ source, pension payments and commutations will also be received tax-free. If you are under age 60, tax may apply to pension payments and commutations, although a portion may be tax free and/or entitled to a 15% tax offset.

Investment earnings on the underlying assets of an account-based pension are added to your account entirely tax-free but you are only able to roll over total superannuation savings up to your personal transfer balance cap (for 2023/24, somewhere between nil and $1.9 million) to start retirement income streams. If you have higher savings in superannuation, the balance will need to remain in accumulation phase (with 15% tax) or be taken out of superannuation.

It is also important to note that the tax-free status of earnings will not apply to any pensions paid under the transition to retirement (TTR) rules. The earnings in a TTR pension will be taxed at 15%.

In the event of your death, the account balance may be paid to your beneficiaries or estate as a lump sum. Some beneficiaries may be eligible to select to continue the benefit as a pension. This is a complex area and advice can help determine the best option.

Your situation can be examined to determine the taxation implication of account-based pensions.

What about the disadvantages?

Probably the biggest disadvantage is the risk that an account-based pension may not last your lifetime. This will largely be determined by the investment performance of the underlying assets and how much you choose to take out each year.

There is also a limit on how much money you can use to start account-based income streams.

Illustration of an account-based pension

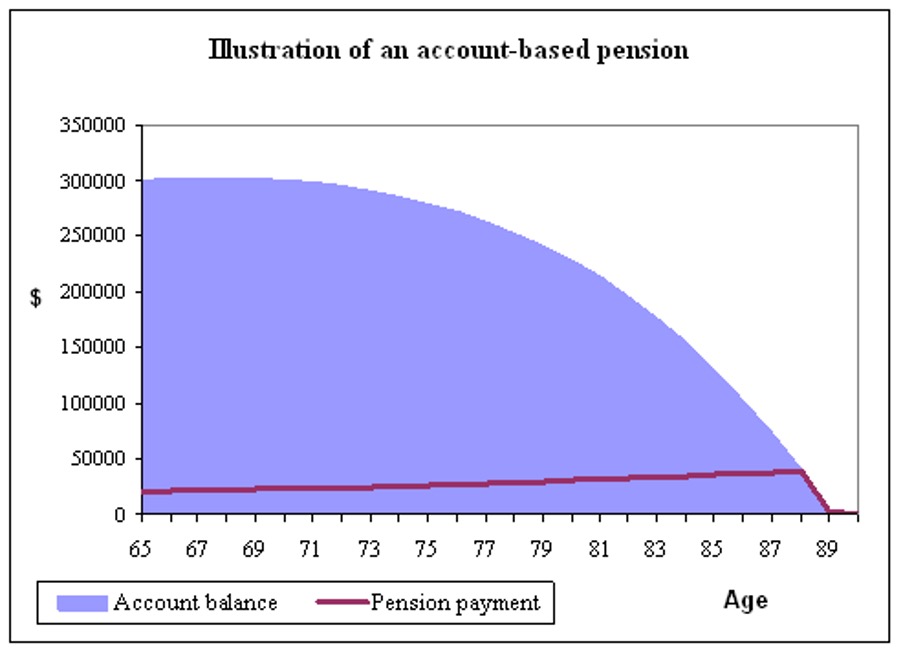

Consider an account-based pension purchased by a 65-year-old for $300,000. Suppose the assets earn 7% p.a. and the annual pension is elected to be $20,000 indexed at 3% each year.

The following graph indicates the pension that is paid each year as well as the account balance over time.

Is an account-based pension for you?

For most retirees, account-based pensions will play a significant role in generating retirement income.

The attractions are undoubtedly the flexibility and the tax-free environment from age 60. It makes sense to consider investing part of your retirement savings in an account-based pension to provide flexibility to meet your changing needs but with advice to ensure your individual needs are met most effectively.